2025 Simple Ira Contribution Limits 2025 - Max Roth Ira Contributions 2025 Libbi Othella, Employees 50 and older can make an extra $3,500. Simple Ira Limits 2025 And 2025 Carol Cristen, The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

Max Roth Ira Contributions 2025 Libbi Othella, Employees 50 and older can make an extra $3,500.

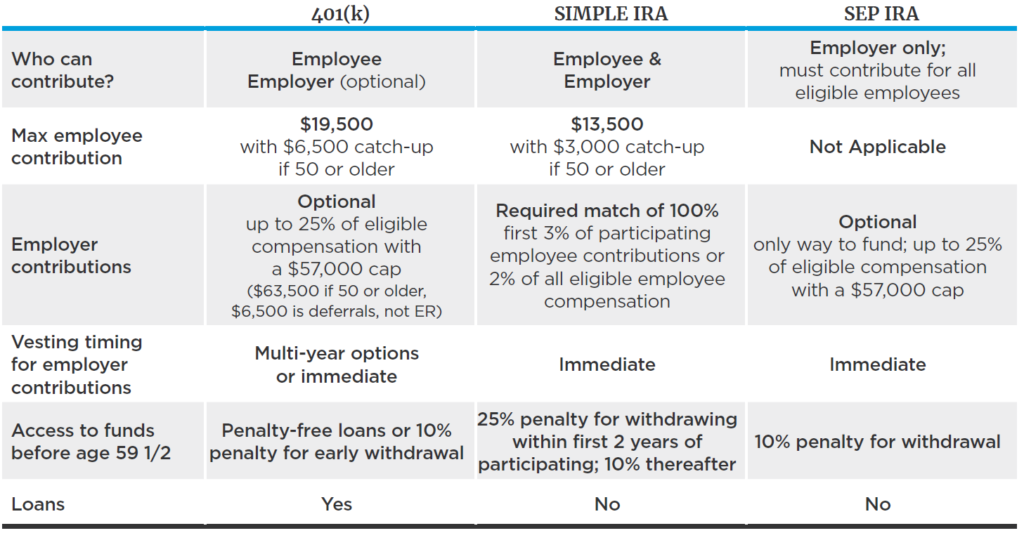

Maximum Ira Contribution 2025 Catchup Edith Heloise, An employee cannot contribute more than $16,000 in 2025 ($15,500 in 2023) to a simple ira.

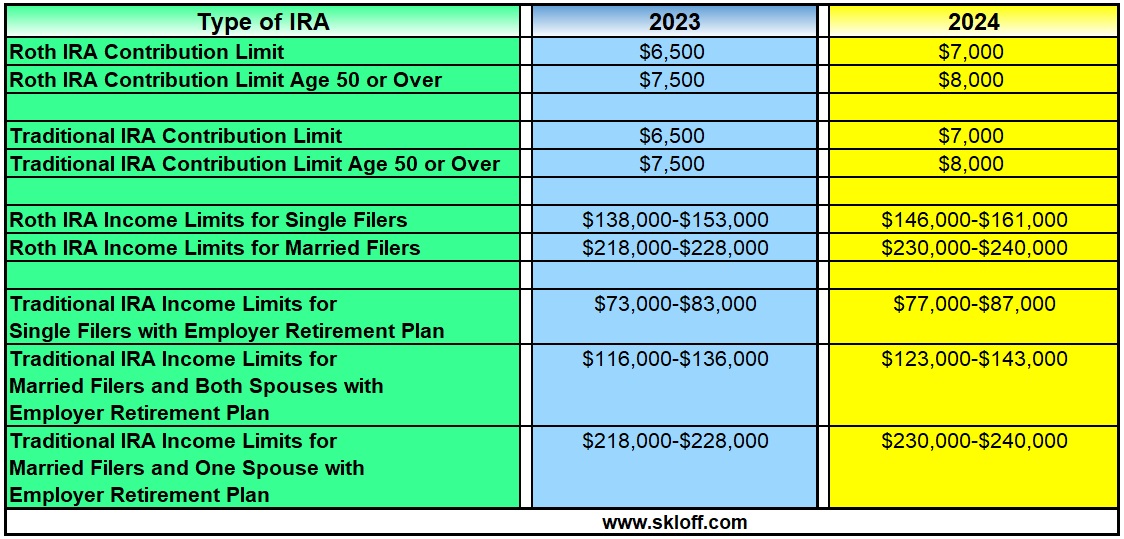

2025 Simple Ira Contribution Limits For Over 50 Evie Oralee, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

The simple ira contribution limit for employees in 2025 is $16,000. If you are 50 and older, you can contribute an additional $1,000 for a.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, Anyone can contribute to a traditional ira, but your ability to deduct contributions.

Maximum Sep Ira Contribution For 2025 Suzy Zorana, The 2025 simple ira contribution limit for employees is $16,000.

Simple Ira Limits 2025 And 2025 Carol Cristen, Effective january 1, 2025, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that.

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

Scentsy Fall Winter Catalog 2025. Scentsy products include flameless wax candle fragrances in unique scents, […]

Simple Ira Contribution Limits 2025 Catch Up Becka Klarika, Effective january 1, 2025, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that.

Tax Brackets 2025 Rsa. Rates of tax for individuals. 10 percent, 12 percent, 22 percent, […]